Kasasa: Everything You Need to Know

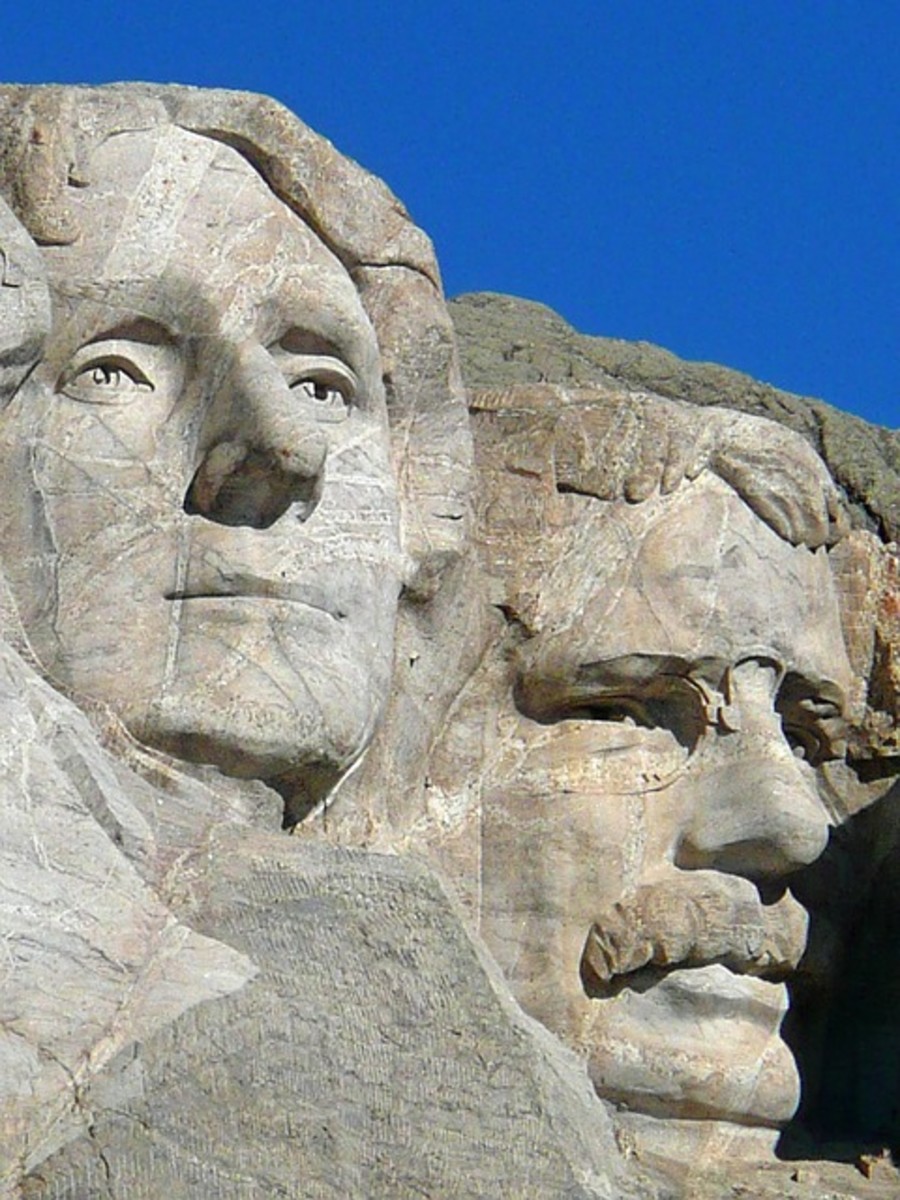

Where does your interest rate on checking or savings fall?

What is Kasasa?

Never heard of Kasasa? Don't worry, you aren't the only one. In fact, until just a few weeks ago, I had never come across the term despite having multiple checking, savings and retirement accounts to my name. It wasn't until my supposed high-yield savings account dropped it's rate (again!) that I came across this new wave of thinking.

So what is Kasasa?

Kasasa is a financial services brand owned by BancVue. It reaches out to small, local banks and credit unions to roll out a system of free checking and savings accounts that can also features high yields. I say can because the high yields have to be activated through monthly user actions, but most are incredibly easy to achieve. Even if you fail to reach the requirements for the months, you still are given a small rate of interest (usually 0.10%), your checking remains free, and you can still receive the high rate the next month you qualify.

What Do I Have to Do to Get the High Rates?

(There a quite a few options Kasasa provides, including Saver, Giving (which earns money to donate) and Cash Back, but for this article, we'll use Kasasa Cash (the standard checking option), as it's the most widely available service.)

Getting the high-yield rates for most Kasasa Cash (KS) accounts involve completing just four actions every month. The specific details of the actions may vary by bank, but this will give you the general idea of what to expect.

The first thing, and likely the one most difficult to do, is using your debit card for purchases. Most KS accounts require at least 10 monthly transactions with your debit card, with some requiring more. (My bank requires 12, for example). The reasoning behind this is that each debit card swipe creates revenue for the financial institution the card belongs to -- amounting to approximately two percent of the purchase.

These required transactions do not mean you have to be a heavy spender, however. In my research, I didn't come across transaction amount minimums for the purchases, so making a trip to the quick stop every couple days for some gum or a coffee should get you there.

If you are a person who likes using credit cards for rewards or cash to limit your spending (like me), you will have to adopt a new spending strategy. (My personal anecdote: I will use the debit card for small, single digit transactions and use my credit cards for larger transactions. This will keep the monthly average balance higher, creating more generated interest).

The other three requirements are relatively easy and will take little to no effort on your part.

Users must be enrolled and log into online banking at least once a month. The theory for this is that online users are more self-sufficient, and thus, require less customer service, which int turn lowers the institution's overhead. Users must also be enrolled in e-statements instead of paper statements. Financial institutions estimate that each paper statement printed and mailed costs about two dollars, a cost that can quickly add up. Finally, users must make an automatic payment (although most institutions allow for direct deposit instead). This can easily be achieved by paying monthly power or cable bills or even sending payments to lawn care providers or babysitters.

Institutions and Rates By State

State

| Institutions

| Average Rate

|

|---|---|---|

AL

| 4

| 2.13

|

AR

| 4

| 2.82

|

AZ

| 3

| 2.50

|

CO

| 1

| 3.00

|

CT

| 1

| 1.50

|

FL

| 2

| 1.63

|

GA

| 5

| 2.40

|

IA

| 3

| 3.10

|

ID

| 1

| 0.76

|

IL

| 18

| 1.88

|

IN

| 5

| 2.17

|

KS

| 2

| 2.02

|

KY

| 4

| 2.24

|

LA

| 9

| 2.98

|

MA

| 1

| 2.00

|

MD

| 2

| 2.51

|

ME

| 4

| 2.50

|

MI

| 6

| 2.30

|

MN

| 9

| 2.18

|

MO

| 8

| 1.85

|

MS

| 8

| 2.57

|

NC

| 1

| 1.50

|

ND

| 2

| 2.25

|

NJ

| 5

| 2.06

|

NY

| 5

| 2.01

|

OH

| 8

| 2.20

|

OK

| 1

| 2.51

|

OR

| 3

| 2.53

|

PA

| 5

| 2.35

|

SC

| 1

| 1.01

|

SD

| 4

| 2.65

|

TN

| 6

| 2.00

|

TX

| 5

| 2.12

|

UT

| 1

| 2.15

|

VA

| 2

| 2.18

|

VT

| 1

| 2.01

|

WA

| 2

| 2.13

|

WI

| 4

| 2.55

|

WV

| 1

| 2.00

|

WY

| 1

| 2.00

|

What Are the Rates?

Rates, like the monthly requirements, vary based on financial institution. The lowest rate currently offered by a Kasasa provider is 0.5 percent (found at Security Bank in Springfield, IL and Wood & Huston Bank in Marshall, MO), with rates rising as high as 4.01 percent (Pelican State Credit Union in Louisiana). There are 32 providers that offer rates at 3.00 percent or higher with an additional 41 exceeding 2.50 percent. The average rate nationwide comes in at 2.24 percent, which is 2.8 times higher than American Express Savings Bank's high-yield savings account.

Unfortunately, Kasasa is predominantly in the eastern half of the US. Only 10 of the 159 financial institutions are found in the seven western-most states (Hawaii and Alaska excluded), with none being found in California or Nevada. That number includes Idaho, which has the nation's lowest average rate for Kasasa, with just one institution (Bank of Idaho) offering a dismal 0.76 percent.

The state with the highest average is Iowa. The Hawkeyes' three banks average out at 3.10 percent, with Iowa State Bank's 3.25 percent leading the charge.

Louisiana, whose nine banks average 2.98 percent, offers the greatest choices. The Bayou has the previously mentioned Pelican State in addition to six other banks that exceed 3.00 percent, the most in the country.

The table to the right shows how each state fares in participation and rate.

How Will I Know If I Qualified?

At the end of each monthly cycle, your Kasasa provider will send you an email letting you know if you qualified for that month, and how you did on each of the requirements. They will also let you know the upcoming qualification end dates, so you can ensure that all activity required is completed in time. (Remember, transactions must post and settle by the end date, so don't wait until the last day to use your debit card.)

Are There Any Other Benefits?

Yes, Kasasa realizes that a major draw to the nationwide banks is the ability to get cash all over the country without being hit with ATM fees out the wazoo. To help counter this, Kasasa offers ATM fee refunds for all accounts that meet the monthly requirements. Regardless of bank or location, Kasasa will refund any ATM fee, up to $25 per month (or so), across the country. (Note that some institutions may require an ATM receipt for large ATM fees, usually in excess of $5).

What's the Catch?

There is no catch. At the bare minimum, you get a free checking account that provides an interest rate that would likely trump most major banks rates on savings accounts. If you use Kasasa correctly, you not only come away with a decent return but help the financial institution make and save money and keep that money local. This money can help the credit unions and local banks continue to fund small businesses and farmers, something they do in disproportionate amounts already. As the Infograph below shows, that's a very good thing.

The only possible catch comes in regard to account balances. The advertised rate is only valid for amounts under the financial institution's limit. This limit varies from $5,000 to $50,000 with most falling in the $15,000 to $20,000 range. Amounts above the limit will usually earn interest at the non-promotional rate, with some banks offering a sliding scale. To offset this, users can sign up for a Kasasa Saver account. The Saver accounts generally earn less interest than Kasasa Cash, but enable users to earn interest at a rate (usually) above market level on amounts above the KC limits.

Why Aren't There More Locations?

Usually if something is great, it spreads like wildfire and takes the nation by storm, so why isn't Kasasa in more locations? I asked that exact question to the Vice President of Finance at a credit union that didn't carry Kasasa. The VP's answer: the cost.

While Kasasa is great for the consumer, there are heavy front-end costs for the financial institutions. Specific costs weren't given, but according to the VP, the large set up costs and the monthly fees priced Kasasa out of the credit union's plan.

If a financial institution doesn't believe that the membership base resulting from Kasasa will generate enough revenue to offset those costs, they will likely pass in lieu of their own rewards-style checking.